在鲍威尔发言与美联储政策文件公布以后,媒体的目光仍然放在了灵活的通胀目标之上,似乎市场已经获得了自己想要的东西——联储容忍更高的通胀,意味着更低的实际利率=鸽派表态。

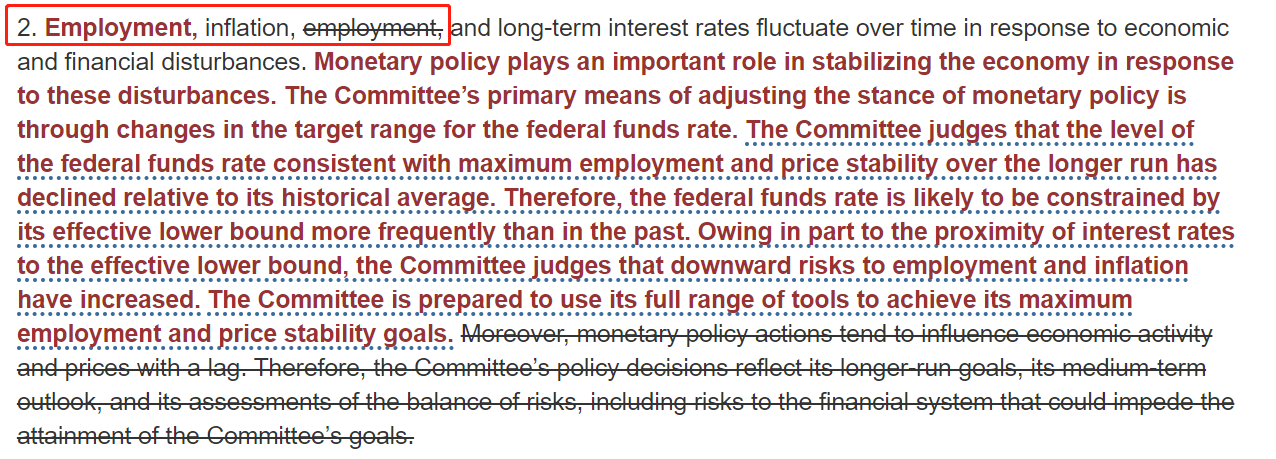

但事实情况并没有这么简单,点进联储新公开的Statement on Longer-Run Goals and Monetary Policy Strategy(长期目标与货币政策策略声明)如下图:

(Employment莫名其妙地被提前了):

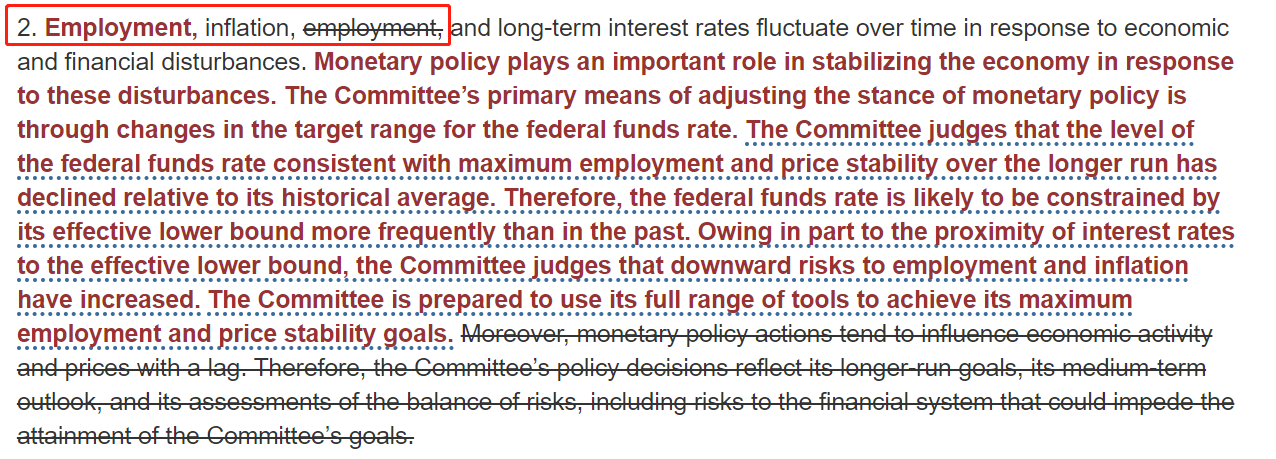

此外,美联储对就业目标的论述也做出了一些奇怪的修改,首先是增加了broad-based and inclusive goal,配合BLM的大背景与联储内部对族裔就业的研究,意味着就业目标不再单单关注总量指标,还要做到关注广义的,泛族裔的结构性目标。

在鲍威尔的讲话中,还有有关就业目标的一个细节:

In addition, our revised statement says that our policy decision will be informed by our "assessments of the shortfalls of employment from its maximum level" rather than by "deviations from its maximum level" as in our previous statement.24 This change may appear subtle, but it reflects our view that a robust job market can be sustained without causing an outbreak of inflation.

再来看批注:

Italics added for emphasis. The 2012 statement noted that the Committee would mitigate "deviations" of employment from the Committee‘s assessments of its maximum level, suggesting that the Committee would actively seek to lower employment if it assessed that employment was above the Committee‘s estimate of its maximum level. In practice, the Committee has not conducted policy in this way, but rather has supported continued gains in the labor market.

Deviations,偏离,其中暗指了美联储就业目标的对称性或者双向性,也就是说如果就业水平超出充分就业水平就可能预示联储要降低就业来避免过热造成通胀,也因此暗指加息。

Shortfalls,不足,不再暗指就业目标的双向性,还声称要支持持续的劳动力市场改善,是纯粹单向性的了,还补充了一句联储认为就业市场可以在通胀不大涨的前提下持续的处于稳固的状态。再进一步——就业过热不再是问题!

综合来看,新的框架不仅仅是允许通胀超调!而是同时允许就业市场也超调(过热)!之前我们都过度地重视了通胀目标,而没有意识到联储是需要通过就业市场来达到其通胀目标的,换句话说,虽然菲利普斯曲线已经扁平化了,但是联储仍然相信菲利普斯曲线。

允许通胀超调+允许就业市场过热累加起来,实质就是名义GDP目标,而这是前美联储主席耶伦所青睐的。(伯南克所推崇的则是平均通胀目标及价格水平目标)

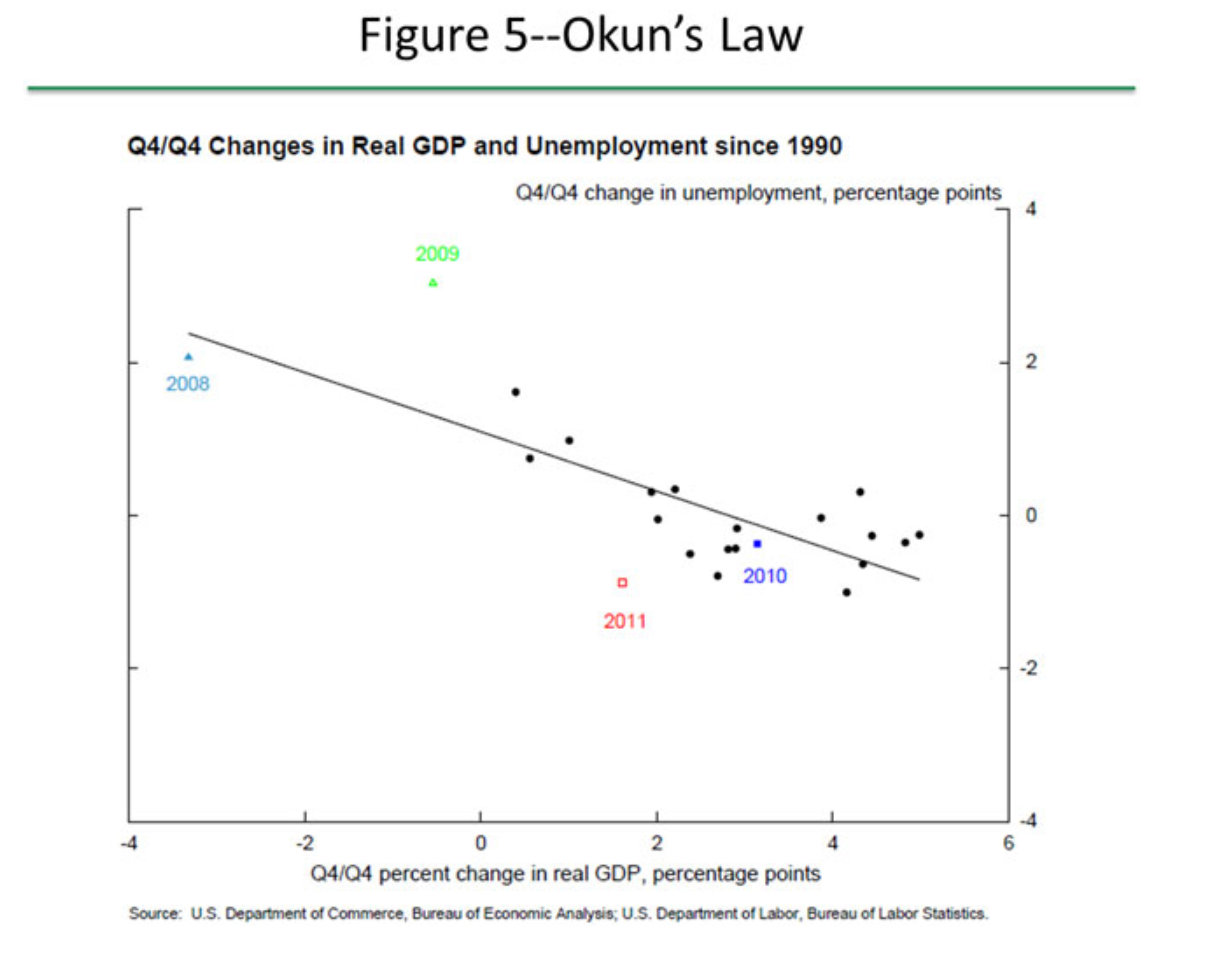

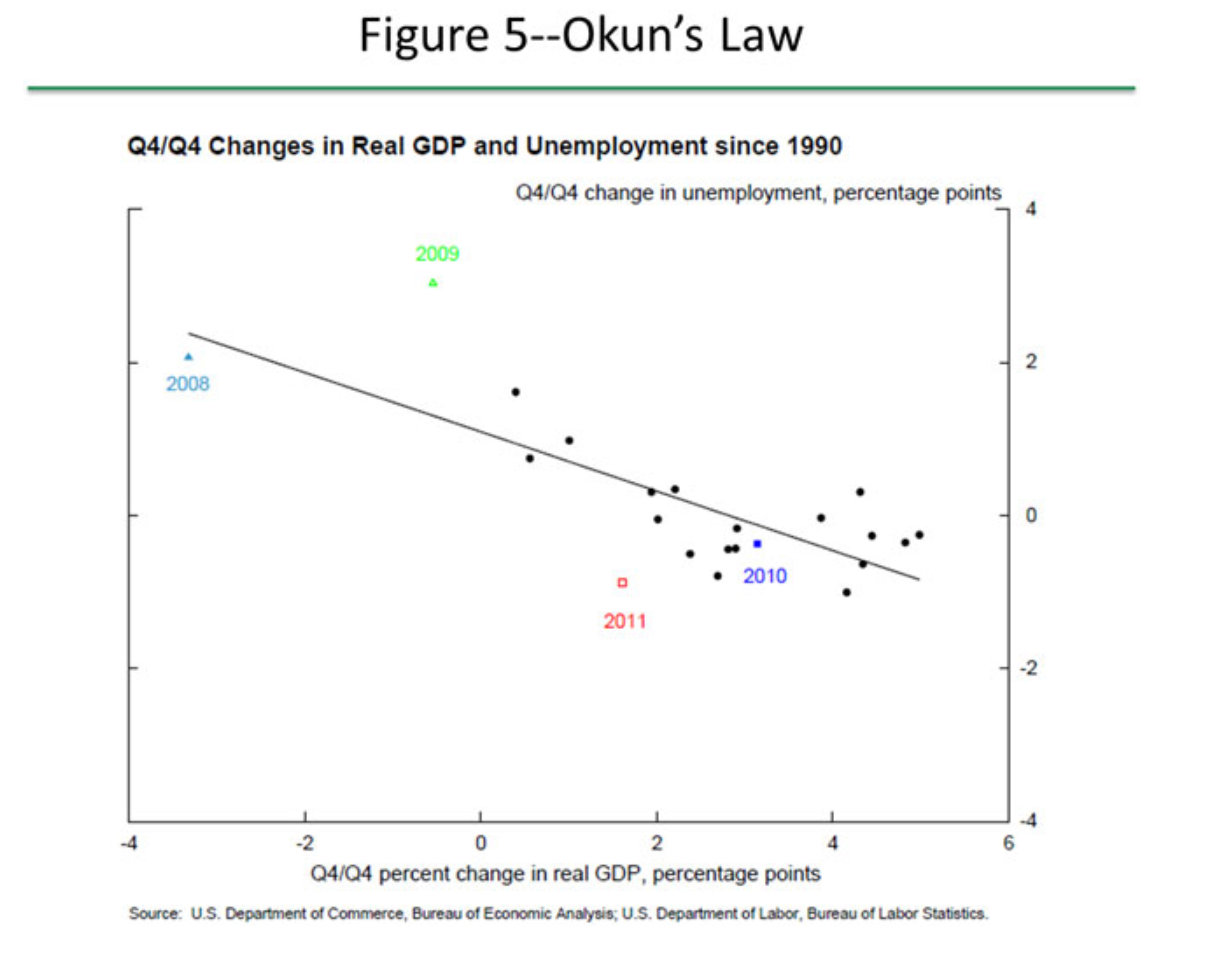

请看耶伦2012年4月11日的演讲,她提到了奥肯定律!

To illustrate this puzzle, figure 5 plots changes in the unemployment rate against real GDP growth--a simple portrayal of the relationship known as Okun‘s law. It is evident from the figure that 2011 is something of an outlier, with the drop in the unemployment rate last year much larger than would seem consistent with real GDP growth below 2 percent. One possibility, highlighted by Chairman Bernanke in a recent speech, is that last year‘s decline in unemployment represents a catch-up from the especially large job losses during late 2008 and 2009.7 According to this hypothesis, employers slashed employment especially sharply during the recession, perhaps out of concern that the contraction could become even more severe; in particular, the figure shows that in 2009, the unemployment rate rose by considerably more than the decline in GDP would have suggested. Then, last year, employers may have become confident enough in the recovery to increase hiring and relieve the unsustainable strain that the earlier cutbacks had placed on their workforces. I think the evidence is consistent with this hypothesis, and I have incorporated it into my own modal forecast.

If last year‘s Okun‘s law puzzle was largely the result of such a catch-up in hiring, I would expect progress on the unemployment front to diminish unless the pace of GDP growth picks up. After all, catch-up can go on for only so long. Of course, there are other conceivable explanations for this puzzle, including some that would point to a faster decline in unemployment in coming years. For example, GDP could have risen more rapidly over the past year than current data indicate. It will be important to pay close attention to indicators of both the labor market and GDP to try to gauge the likely pace of improvement in economic activity going forward and, hence, the appropriate stance of monetary policy over time.

简言之,耶伦框架是从奥肯定律出发的——实际GDP的增长需要提高才可以改善就业——改善就业以后通过菲利普斯曲线传导到通胀——以实现联储的通胀目标(2%)。

放到当前的环境下,联储强调通胀可以超调且就业市场可以过热且需要广泛的改善,那么你可以据此倒推——为实现短期超过2%的通胀需要就业市场也同时超调——为实现就业市场的大幅改善需要实际GDP的大幅改善——实质是一个名义GDP目标,同时联储相信过热的就业未必会转化为通胀失控。

返回外汇网首页,查看更多>>

返回外汇网首页,查看更多>>